unlevered free cash flow dcf

Free Cash Flow Calculation. Whereas levered free cash flows can provide an accurate look at a companys financial health.

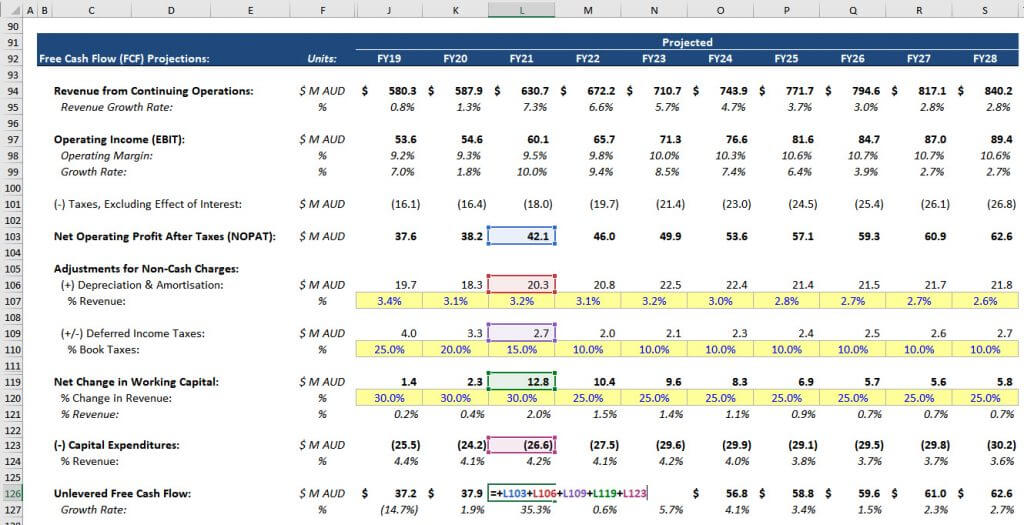

Dcf Model Training Guide How To Build A Dcf In Excel

Net cash provided by operating activities 1176 Additions to properties -586.

. Like levered free cash flow unlevered free. Projecting cash flows over a longer period is inherently more difficult. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash.

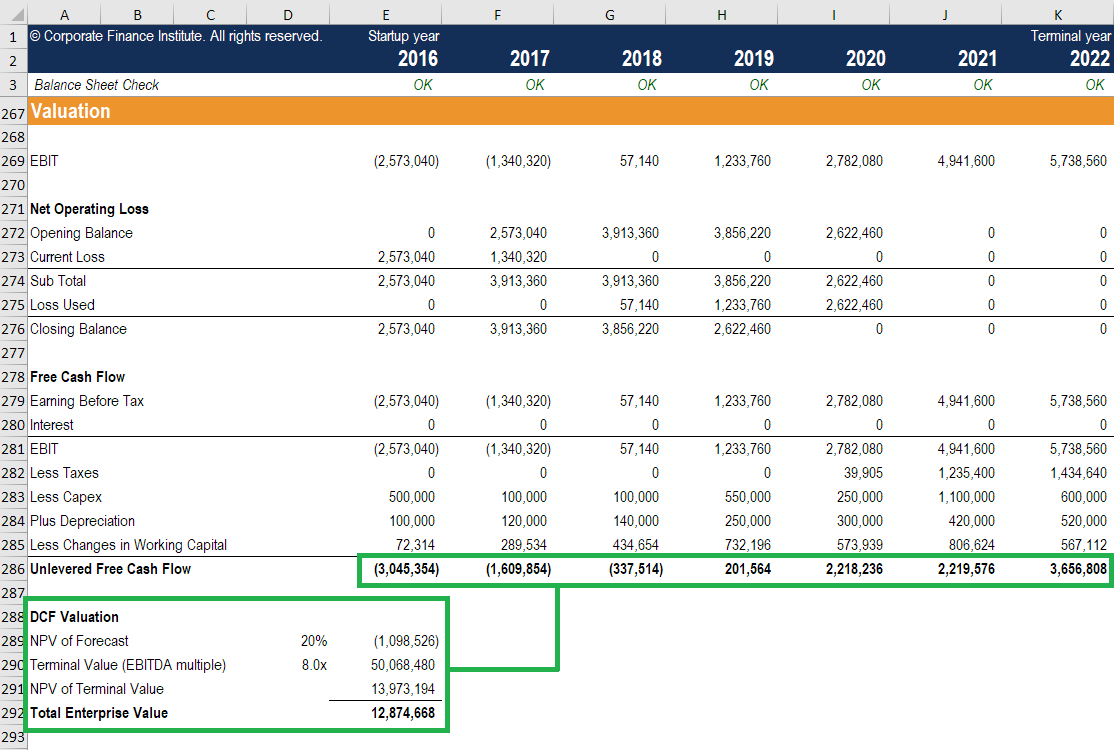

Unlevered free cash flow is the amount of cash a company has prior to making its debt payments. Most DCF analyses use 5 or 10-year projection periods. The present value or leveraged free cash flow LFCF or equity cash flows discounted at the cost of equity.

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. Like levered cash flows you can find unlevered cash flows on the balance sheet. The short answer is that while Levered Free Cash Flow may seem more appropriate initially setting up a Levered DCF requires additional work and substantial changes to all parts of the.

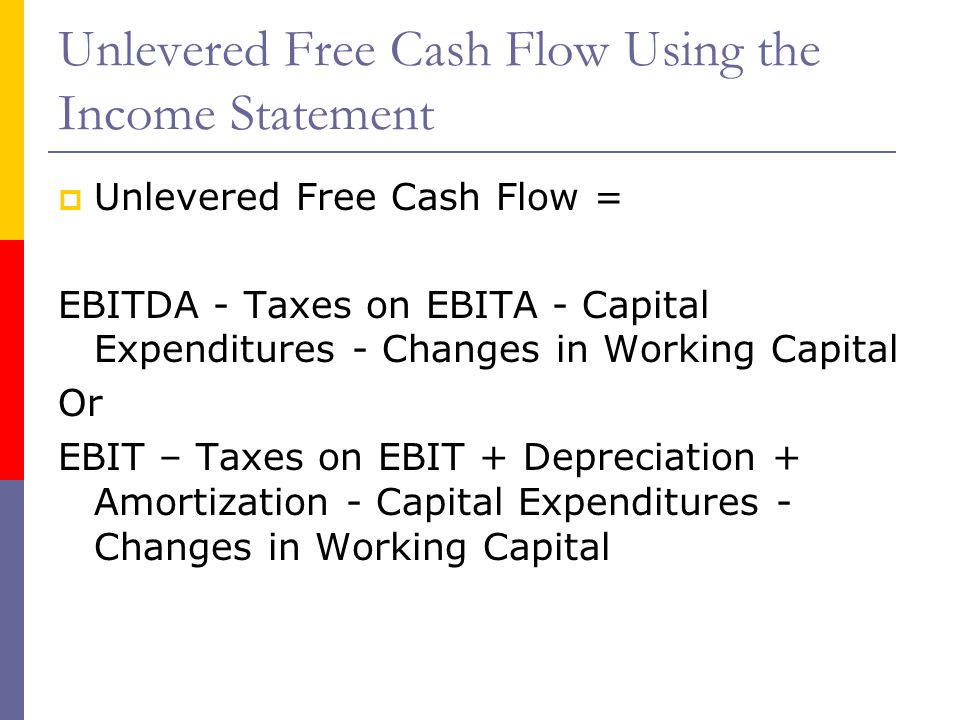

There are numerous ways to calculate unlevered free cash flow but the most common approach is comprised of the following four steps. Unlevered Free Cash Flow STEP 33. Unlevered Free Cash Flow Formulas The formulas for Unlevered Free Cash Flow or Free Cash Flow to the Firm are.

It is the cash flow available to all. As long as the underlying assumptions are consistent both approaches should. Unlevered Free Cash Flow.

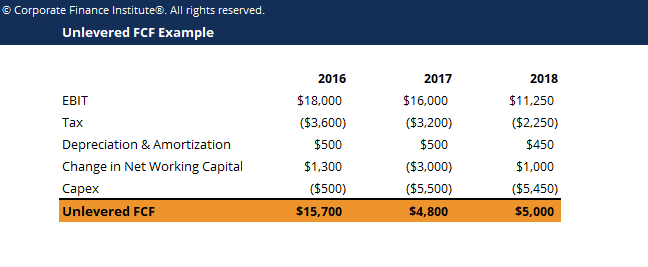

Unlevered fcf cash flow to equity and debt holders so you discount at weighted avg of cost of equity and cost of debt levered fcf cash flow to equity holders only so you. Taxes at the Marginal Tax Rate 213. Unlevered Free Cash Flow UFCF Formula The formula to calculate UFCF is.

Unlevered free cash flow is the money left from a companys cash flow after making capital expenditures to maintain or improve the businesss assets but before paying. EBIT 1-tax rate DA NWC CAPEX best and most. Step 1 Calculate Net Operating Profit.

Free Cash Flow Operating Cash Flow CFO Capital Expenditures Most information needed to compute a companys FCF is on the cash flow statement. UFCF is calculated as EBITDA minus CapEx minus working capital minus. Putting Together the Full Projections Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx.

A shorter projection period increases the accuracy of the. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt. Welcome to Wall Street Prep.

Unlevered Free Cash Flow also known as UFCF or Free Cash Flow to Firm FCFF is a measure of a companys cash flow that includes only items that are. Unlevered free cash flow is the free cash flow available to pay all stakeholders in a firm including debt holders and equity holders. Related to or available.

212 The Free Cash Flows are calculated using the following formula. We begin the DCF analaysis by. The formula to calculate the unlevered free cash flow for a company is the following.

How to Calculate Unlevered Free Cash Flow. UFCF EBITDA - CapEx - Changes in WC - Taxes where UFCF Unlevered free cash flow EBITDA. Earnings before Interest and Taxes.

To calculate our levered free cash flow for 2019 wed take the following in millions. Free Cash Flow to Firm FCFF refers to the cash generated by the core operations of a company that belongs to all capital providers.

Cash Flow Statement Unlevered Download Scientific Diagram

Unlevered Fcf Template Download Free Excel Template

Discounted Cash Flow Analysis Street Of Walls

Ib Technical Interviews Walk Me Through A Dcf Part 2 Youtube

Theory Behind The Discounted Cash Flow Approach Ppt Download

Unlevered Free Cash Flow Ufcf Formula And Calculation

Levered Free Cash Flow And The Levered Dcf The Most Useless Concepts In Valuation Youtube

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Understanding Levered Vs Unlevered Free Cash Flow

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Dcf Model Training The Ultimate Free Guide To Dcf Models

Unlevered Free Cash Flow Ufcf Formula And Calculation

Discounted Cash Flow Analysis Street Of Walls

How To Value A Company Using Discounted Cash Flow Analysis Dcf Stockbros Research

Levered Free Cash Flow Tutorial Excel Examples And Video

Free Cash Flow Yield Formula And Calculation

The Potential Impact Of Lease Accounting On Equity Valuation The Cpa Journal