maryland student loan tax credit 2021

Are you thinking about the services of a debt negotiation company debt negotiation consolidation or a tax obligation debt relief firm maryland student loan debt relief tax credit. With more than 40 million distributed through the program.

Maryland Taxpayers May Qualify For Student Loan Debt Relief Tax Credit

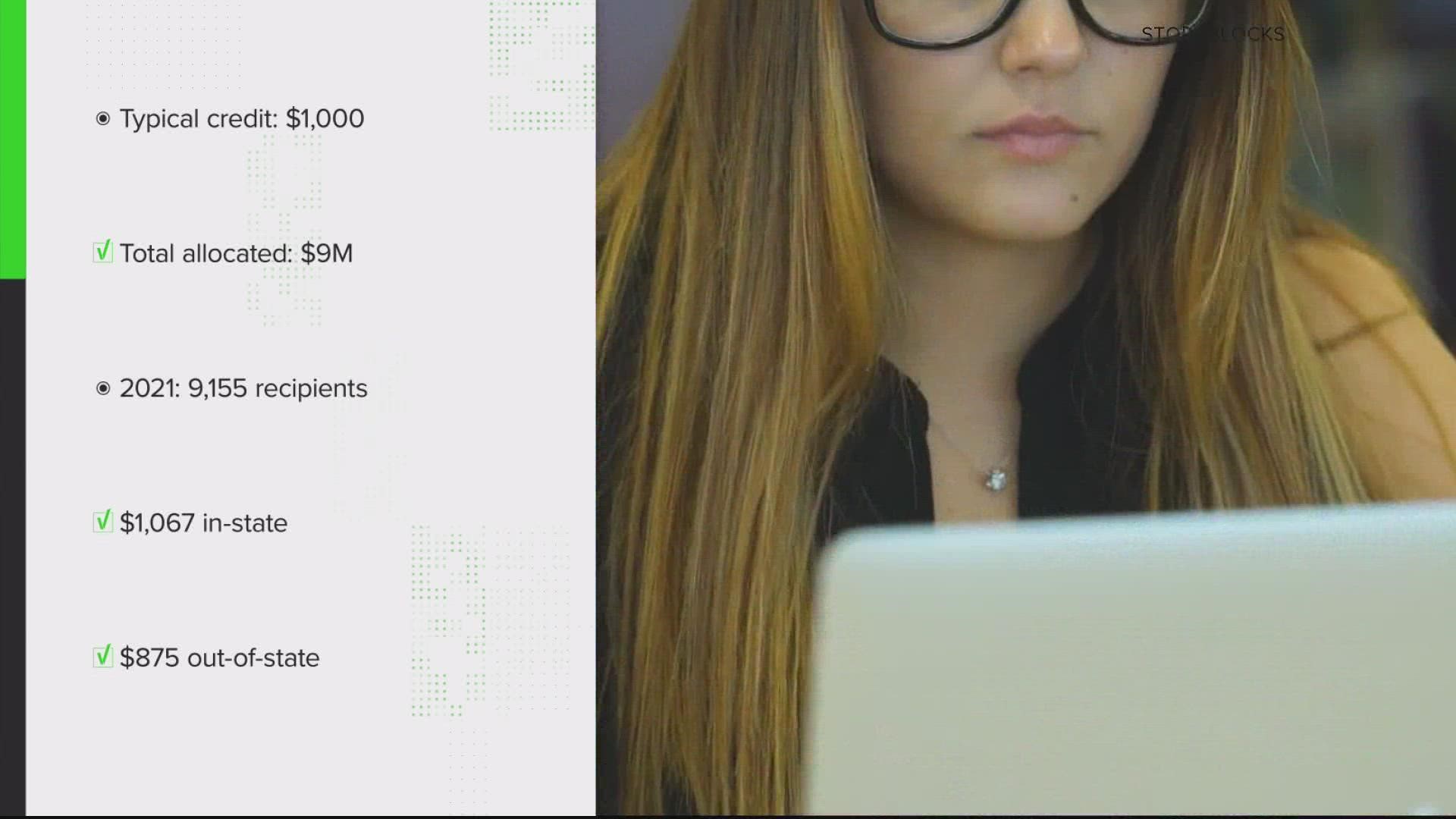

More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017.

. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt. How much money is the Maryland Student Loan Debt Relief Tax Credit.

2 increasing to 100000 the maximum value of the credit. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. Complete the Student Loan Debt Relief Tax Credit application.

Going to college may seem out of reach. Individuals who earned less than 125000 in either 2020 or. And 3 expanding eligibility for the tax credit by eliminating the requirement that a student must have had at least.

Fiscal and Policy Note. Detailed EITC guidance for Tax Year 2021. Workplace Enterprise Fintech China Policy Newsletters Braintrust portrait artists Events Careers hong kong district court case search.

The application for President Joe Bidens student loan forgiveness plan is expected to go live as soon as this week. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are.

Howard County Executive Calvin Ball Do You Have Student Loans Maryland Taxpayers Who Have Incurred At Least 20 000 In Undergraduate And Or Graduate Student Loan Debt And Have At Least 5 000 In

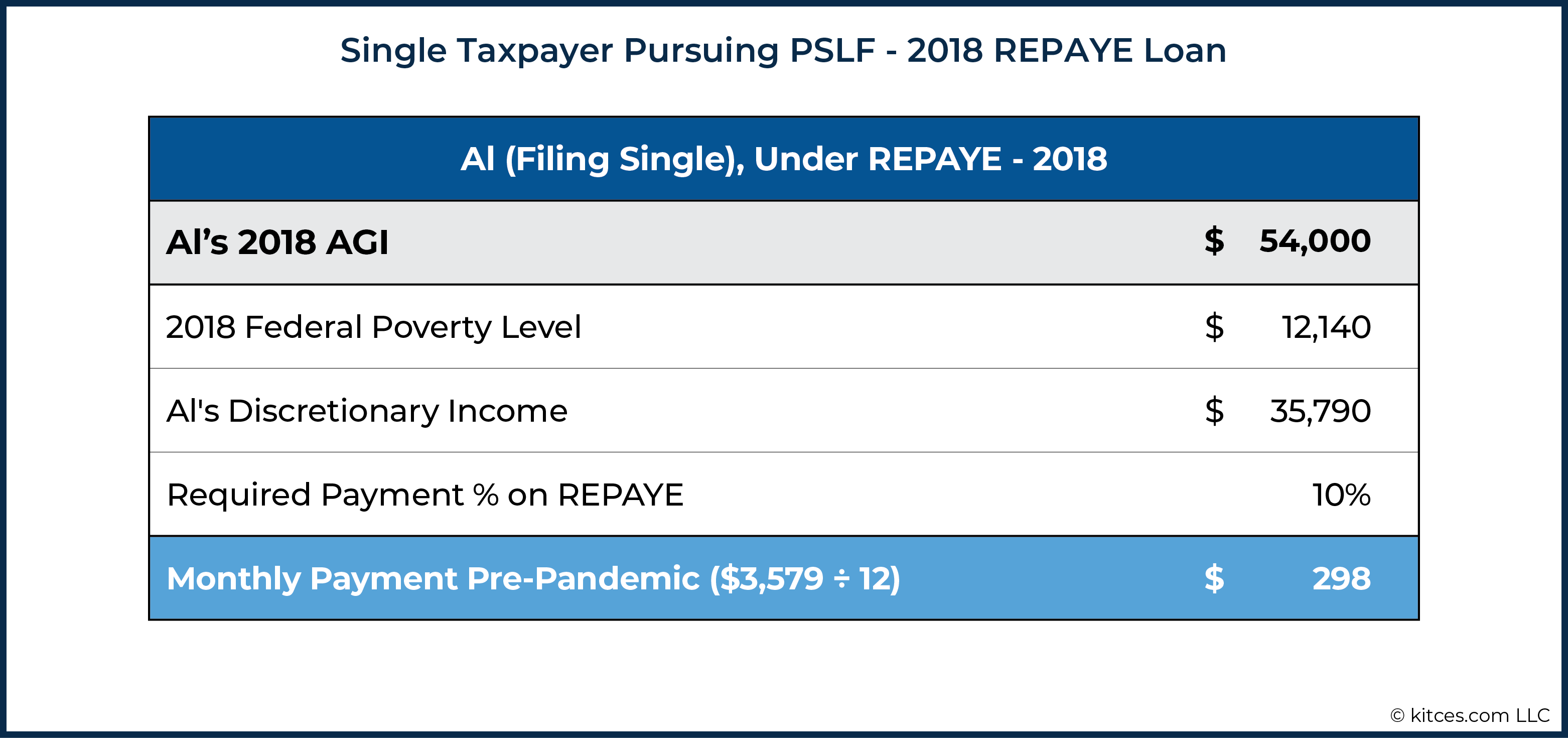

Income Recertification Planning As Student Loan Freezes Ends

Learn How The Student Loan Interest Deduction Works

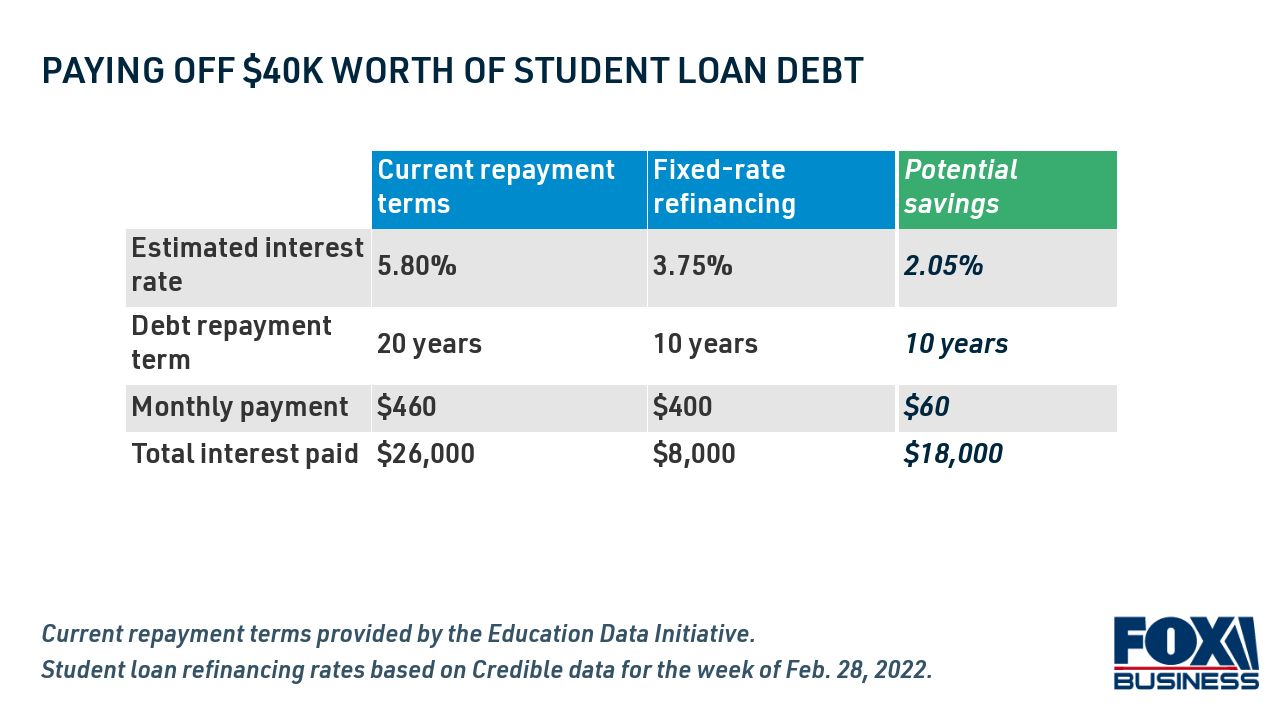

This State Wants To Pay Off 40k In Student Loan Debt For First Time Homebuyers Fox Business

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

Maryland S 1 000 Student Debt Relief Tax Credit How To Apply Deadline

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Quick Guide Maryland Student Loan Debt Relief Tax Credit

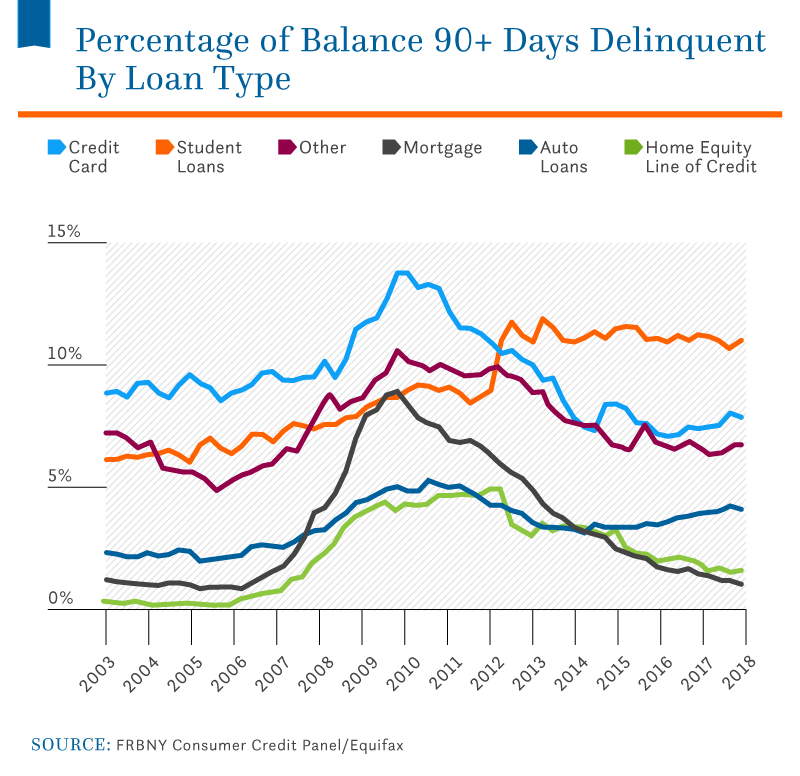

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

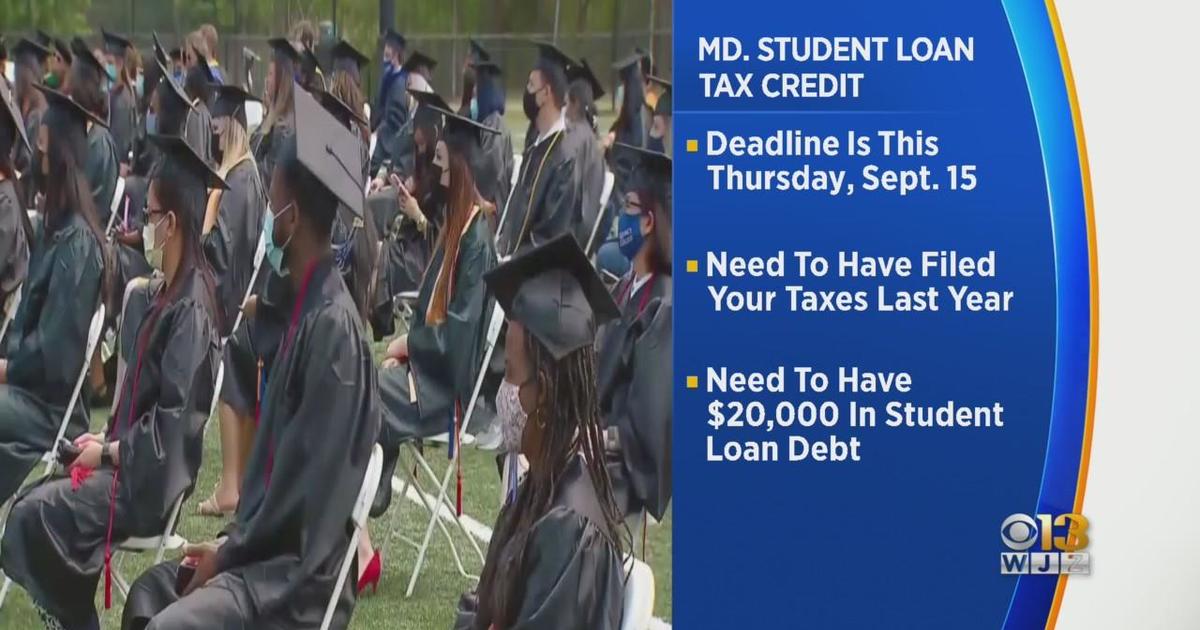

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

Vita Free Tax Preparation Human Services Programs Of Carroll County

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Maryland Student Loans Debt Statistics Student Loan Hero

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

Student Loan Debt 2022 Facts Statistics Nitro